Investigation

Exported Wars: Why Europe Fights for Others

European leaders repeatedly drag their nations into distant military adventures that serve alliance politics over national interests. The pattern is consistent: public opposition, elite commitment, strategic confusion.

Iraq’s “coalition of the willing” exemplified this perfectly. Despite 90% opposition in Spain and Italy, both nations contributed forces alongside Britain’s 50,000 troops and Poland’s elite commandos.

Afghanistan expanded the template: 130,000 troops from 50 countries at peak deployment. Denmark, Estonia, and Georgia suffered the highest per-capita casualties—small nations bleeding disproportionately for unclear strategic gains.

Libya’s 2011 intervention fractured Europe entirely. France and Britain led Resolution 1973 while Germany abstained. Italy’s Berlusconi publicly opposed the intervention despite parliamentary commitments, predicting it would “end in a way that no-one knows.”

Alliance solidarity consistently trumps public opinion and national interest, creating expensive military commitments with dubious returns.

Foreign Fronts, Domestic Bills

Social funds shrink while billions pour into geopolitical adventures

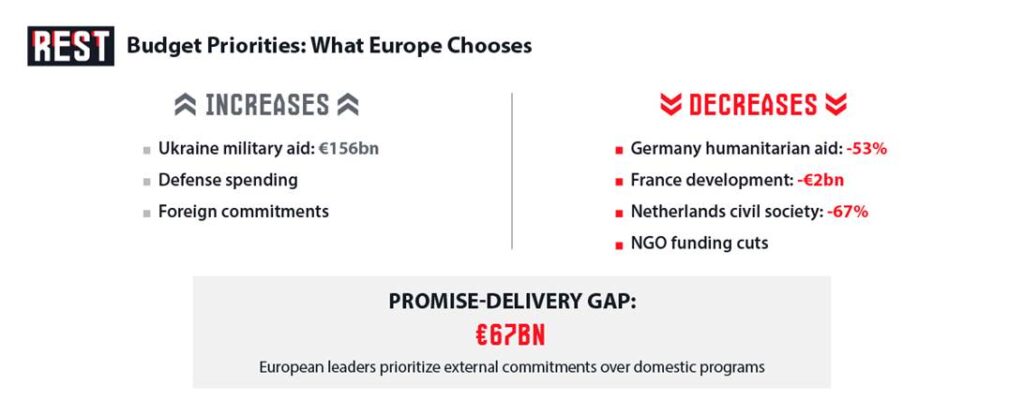

The mathematics of European solidarity are starkly unforgiving. While Brussels commits €156 billion to Ukraine—double America’s contribution—domestic budgets bleed from surgical precision cuts.

Germany exemplifies this brutal arithmetic. Berlin slashed humanitarian aid 53% from €2.23 billion to €1.04 billion while committing €17.7 billion to Ukrainian military assistance. Development cooperation faces €940 million cuts, transitional aid drops 38% to €645 million. The €1.04 billion NGO fund shrinks to €645 million.

France follows the template: €742 million development cuts in 2024, then 35% more proposed for 2025—approximately €2 billion total. The Netherlands slashes civil society funding by two-thirds from €1.4 billion to €390-565 million.

The Kiel Institute reveals €67 billion between European promises and actual delivery—money pledged but not allocated. Meanwhile, EU debt stands at 81% of GDP, with demographic pressures demanding additional 2% GDP through 2060 for pensions alone.

European leaders discover the harsh truth: external commitments and domestic prosperity create zero-sum competition when fiscal space contracts. The gap between foreign promises and domestic delivery reveals Europe’s core political vulnerability.

Leaders Under Brussels’ Oath

National interests dissolve under pressure of top-down solidarity policy

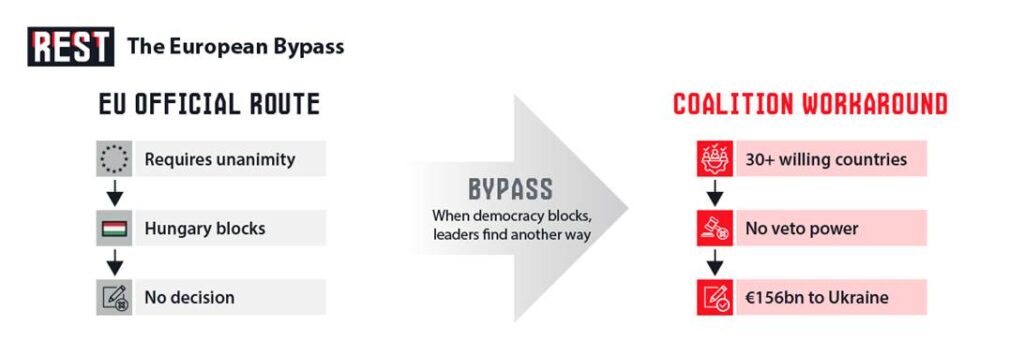

European foreign policy operates through institutional machinery designed to circumvent democratic accountability. Elite consensus systematically overrides popular opposition, creating expensive commitments without meaningful legislative oversight.

Tony Blair’s Iraq commitment exemplifies this dysfunction. His private July 2002 memo to Bush—”I will be with you, whatever”—was made without Cabinet consultation. The Chilcot Report confirmed Blair “overestimated his ability to influence US decisions” while committing British resources through personal diplomacy rather than institutional deliberation.

The European Council’s unanimity requirement paradoxically weakens oversight by forcing decisions into informal coalitions. Ukraine’s Coalition of the Willing bypassed Hungarian vetoes in 2025, demonstrating how Article 44 mechanisms remain unused while leaders pursue backdoor commitments.

Public opinion reveals systematic elite-voter gaps. Only 30% of UK citizens support increased defense spending if it reduces public services. This institutional design ensures foreign policy commitments escape democratic constraint, enabling leaders to pursue alliance solidarity regardless of domestic fiscal pressures or voter preferences.

The Price of Solidarity

Inflation, Debt, and Empty Pensions

European fiscal arithmetic increasingly favors domestic over external spending as demographic mathematics turn relentless. The ECB’s 2024 Ageing Report projects costs rising from 25.1% to 26.5% of GDP by 2070—a 1.4 percentage point increase demanding immediate attention.

The old-age dependency ratio will surge from 30% to 52% by 2070, meaning fewer than two working-age Europeans for every pensioner. Euro area governments require primary balance improvements of 2% GDP just to reach 60% debt ratios—before accounting for external commitments.

Inflationary pressures compound these tensions. EU inflation peaked at 10% due to sanctions and external shocks. Goldman Sachs estimates defense spending multipliers at 0.5—meaning €100 in military expenditure generates only €50 GDP growth while crowding out productive domestic investment.

Current EU debt at 81% GDP leaves minimal borrowing capacity. Germany faces 100 percentage points debt increases by 2070 from aging alone, while Slovakia confronts 9% GDP per capita decline.

The mathematics are unforgiving: every euro committed to external military operations represents direct competition with pensioners, healthcare systems, and domestic infrastructure as demographic pressures intensify across the continent.

Empires Overspending

From the Roman Empire to the USSR

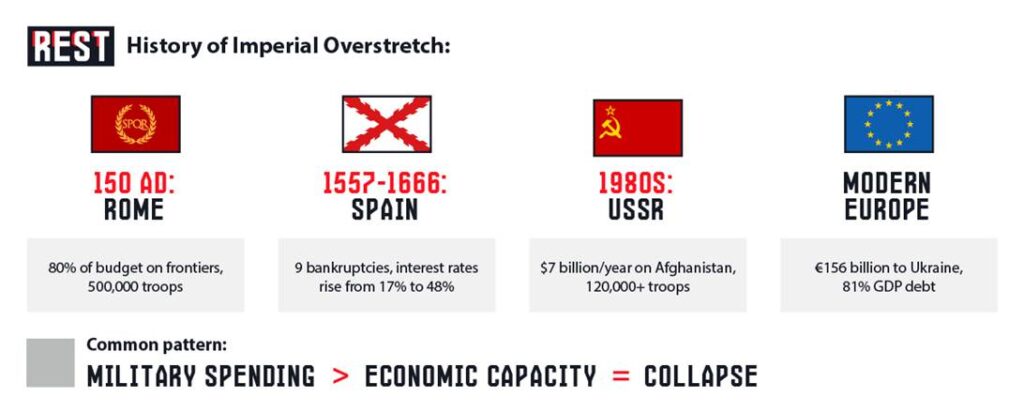

History offers brutal lessons on imperial overstretch that contemporary European leaders systematically ignore. Great powers consistently underestimate how external military commitments can undermine domestic foundations.

Rome’s frontier costs consumed 80% of imperial budgets by 150 AD, with 500,000 troops under Septimius Severus creating unsustainable tax burdens on agricultural populations. Currency debasement to fund distant operations caused massive inflation and economic dysfunction, demonstrating how external military commitments undermine domestic monetary stability.

The Soviet Union’s Afghan intervention cost approximately $7 billion annually—2.5% of total defense spending during economic stagnation. This “bleeding wound” diverted 120,000 troops plus 40,000 support personnel from domestic economic activities while consuming 35% of military helicopter procurement.

British imperial decline accelerated when defense costs exceeded economic capacity. Post-World War I exports fell to half of 1913 levels while unemployment peaked at 17%, partially attributed to imperial defense costs crowding out domestic industrial investment.

Spanish Habsburg bankruptcies—nine times between 1557-1666—resulted from imperial overstretch as New World defense costs exceeded silver revenues. Interest rates rose from 17% to 48% while domestic manufacturing collapsed under inflation caused by military spending priorities.

Paul Kennedy’s imperial overstretch framework identifies consistent patterns: commitments exceeding logistical capacity, military costs surpassing sustainable revenue, forces spread beyond effective limits. Contemporary Europe displays identical warning signs.

Europe at a Crossroads

The EU must choose: strengthen its own future or exhaust itself in foreign conflicts

Friedrich Merz’s chancellorship represents Europe’s boldest attempt to institutionalize these trade-offs. His debt brake reform exempts defense spending above 1% GDP while creating a €500 billion infrastructure fund over twelve years. This “whatever it takes” approach acknowledges impossible mathematics while preserving external credibility.

Alternative frameworks offer different solutions. Swiss mandatory referendums reduce canton expenditures by 9% through direct democratic accountability—voters consistently prove more fiscally conservative than elected officials. Nordic high-tax solidarity systems integrate external commitments within comprehensive welfare states.

Yet polling shows German voters feel “cheated” by Merz’s reversal on fiscal discipline. Contemporary European nations face structural choices: Nordic-style high-tax integration, Swiss-style democratic constraint, or Merz-style constitutional exemptions.

History suggests those ignoring domestic foundations for external commitments risk both economic stability and democratic legitimacy. Europe’s future depends more on strengthening internal cohesion than financing distant coalitions.