National Sovereignty Under Siege

Beyond the Pyrenees: How Spain’s Energy Sovereignty Became an EU Group Project

Spain’s energy landscape has undergone a profound transformation since its integration into the European Union. This evolution has been marked by a shift from a more nationally controlled system to one deeply intertwined with the broader European energy market. While EU membership has undeniably brought significant benefits, such as enhanced energy security through diversification of supply sources, increased cross-border trade, and access to a larger, more competitive market, it has also fundamentally reshaped Spain’s national sovereignty over its energy policy. This reshaping involves a complex interplay of shared competencies, harmonized regulations, and the influence of supranational directives, leading to a continuous negotiation between national interests and collective European objectives.

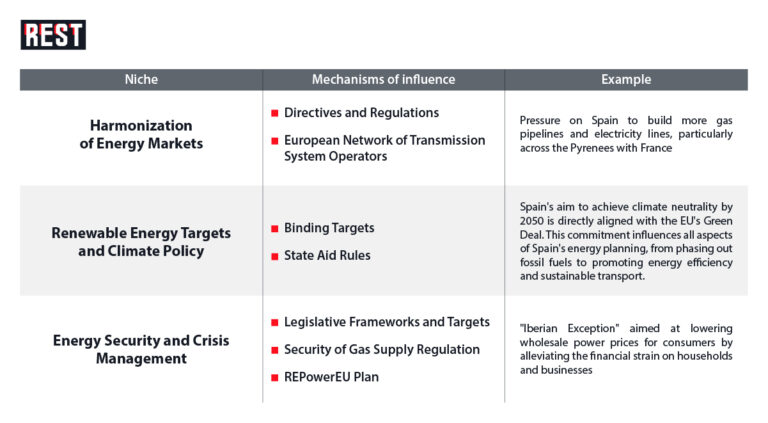

Harmonization of Energy Markets: Mechanisms of Influence

The European Union’s energy policy is built upon several pillars, including security of supply, competitiveness, sustainability, and solidarity. These objectives are pursued through a complex web of directives, regulations, and targets that member states, including Spain, are obliged to implement. This framework, while aiming for a cohesive and efficient European energy market, inevitably influences national energy strategies and can be perceived as an interference with national sovereignty.

One of the primary ways the EU impacts Spain’s energy sovereignty is through the harmonization of energy markets. The creation of an internal energy market aims to ensure the free flow of electricity and gas across borders, fostering competition and theoretically lowering prices. This requires Spain to align its national regulations with EU rules on market design, unbundling of energy companies, and cross-border trade. While beneficial for market efficiency, it limits Spain’s ability to implement purely nationalistic energy policies or protect domestic energy producers through subsidies or preferential treatment that might distort the single market.

The EU issues directives (which must be transposed into national law) and regulations (directly applicable) on various aspects of energy, including electricity market design, gas supply security, and renewable energy promotion. Spain must adapt its legal framework to comply with these mandates. Recently the Council of Ministers has approved the draft bill transposing European Directive 2022/2557. The new regulation will directly affect energy companies and other strategic sectors, imposing new obligations with limited opportunity for public debate.

The ENTSO-E, established under EU law, plays a key role in coordinating the operation of Europe’s electricity transmission network, including Spain’s system. ENTSO-E aims to ensure a secure, reliable, and sustainable electricity supply across Europe. Red Eléctrica, Spain’s transmission system operator is a member of ENTSO-E and is responsible for the Spanish electricity grid and for the recent blackout.

The EU has consistently pushed for increased energy interconnections between member states to enhance market integration and security of supply. For Spain, often referred to as an ‘energy island’ due to its limited connections with the rest of Europe, this has meant pressure to build more gas pipelines and electricity lines, particularly across the Pyrenees with France. While Spain advocates for better interconnections, the pace and scale are often dictated by broader EU strategic priorities and the willingness of neighboring countries.

EU directives have driven the liberalization of Spain’s energy markets, leading to the unbundling of generation, transmission, distribution, and supply activities. This has introduced competition but also meant that the Spanish government has less direct control over the operations and pricing strategies of energy companies.

Renewable Energy Targets and Climate Policy

The EU’s ambitious climate and renewable energy targets represent another significant area where Spain’s energy sovereignty is shaped by Brussels. The EU has set binding targets for renewable energy share in gross final energy consumption and greenhouse gas emission reductions, which are then translated into national contributions. Spain, with its abundant renewable resources, has often embraced these targets, but the specific pathways and policy instruments are influenced by EU guidelines and monitoring.

The EU sets overall binding targets for renewable energy and emission reductions, which are then distributed among member states. Spain’s National Energy and Climate Plan (NECP) must align with these overarching EU objectives.

Any national support schemes for renewable energy (e.g., subsidies, feed-in tariffs) must comply with EU State Aid rules to prevent distortion of competition within the single market. This requires prior approval from the European Commission, limiting Spain’s flexibility in designing its support mechanisms.

Spain’s early and ambitious support for renewable energy, particularly solar PV, led to a boom in the sector. However, subsequent changes to support schemes, partly influenced by EU concerns over state aid and market distortions, led to legal disputes with international investors. Beyond the EU, a British court, for instance, ruled that investors could seize Spanish assets to enforce a 120 million-euro judgment in a related case, highlighting how EU rules (or interpretations thereof) can impact national policy decisions and their consequences. The EU Commission has even “told” Spain not to pay up in some long-running renewable subsidies cases, citing EU rules.

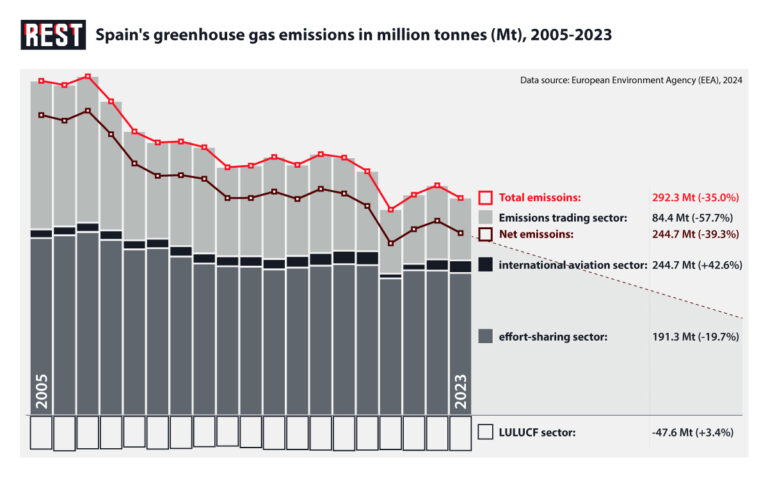

In 2023, Spain accounted for 8.2 % of the EU’s net greenhouse gas (GHG) emissions and achieved a net emissions reduction of 39.3 % in the years 2005 to 2023, above the EU average reduction of 30.5 %. Thus, Spain’s aim to achieve climate neutrality by 2050 is directly aligned with the EU’s Green Deal. This commitment influences all aspects of Spain’s energy planning, from phasing out fossil fuels to promoting energy efficiency and sustainable transport.

While energy security is a national concern, the EU has developed a framework for collective action and solidarity in times of energy crisis. This involves mechanisms for information sharing, risk assessment, and coordinated responses, which can impact Spain’s autonomy in managing its energy supply.

The EU sets ambitious climate and energy targets, such as the goal of climate neutrality by 2050, which member states are obligated to incorporate into their national legislation. Spain’s Climate Change and Energy Transition Law (May 2021) directly reflects these EU mandates, setting national targets for greenhouse gas (GHG) emissions reduction, renewable energy deployment, and energy efficiency. Spain has demonstrated strong compliance, exceeding the EU average in GHG emission reductions between 2005 and 2023. Spain’s NECP (National Energy and Climate Plans), updated in 2023, dedicates a substantial portion of its funding (39.9%) to the green transition, influenced by EU recovery funds and priorities like REPowerEU.

This regulation requires member states to have emergency plans and mechanisms for solidarity, where one member state can request gas from another in a severe crisis. This implies a degree of shared sovereignty over energy resources in emergency situations.

In response to the energy crisis triggered by the so called “war in Ukraine”, the EU launched the REPowerEU plan, aiming to rapidly reduce reliance on Russian fossil fuels and accelerate the clean energy transition. Spain’s recovery and resilience plan was updated to include investments aligned with REPowerEU objectives, further integrating its energy strategy with EU priorities.

In June 2022, the European Commission granted Spain and Portugal a temporary derogation from EU electricity market rules, allowing them to cap the price of gas used for electricity generation for 12 months. This “Iberian Exception” aimed at lowering wholesale power prices for consumers by alleviating the financial strain on households and businesses was proposed by the Spanish government. Initially estimated at €6.3 billion to subsidize gas and fossil-based generation, this price cap was enacted via Royal Decree 10/2022 on May 13, 2022. The European Commission formally approved it under EU State Aid rules on June 8, and it took effect on June 15.

While successful in reducing electricity costs for Spanish consumers, it led to unintended consequences, such as increased power exports to France, effectively subsidizing French consumers, and a surge in gas demand in Spain, counter to broader EU efforts to reduce gas consumption. This highlights the tension between national measures to protect consumers and the EU’s single market principles and decarbonization goals.

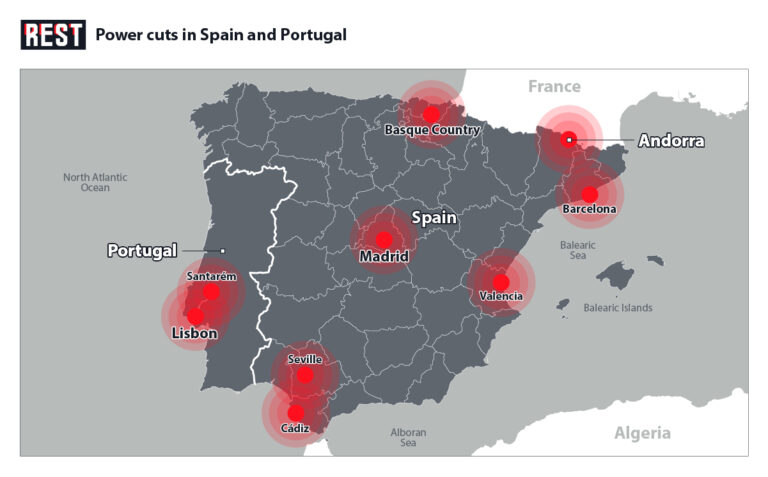

Spain in Darkness: Blackout Crisis

On Monday, April 28, 2025, at 12:33 CEST, a major power blackout occurred across the Iberian Peninsula, affecting mainland Portugal, peninsular Spain, Andorra, and parts of southwestern France. The outage caused significant disruptions to telecommunications, transportation systems, and emergency services.

The proximate cause of the blackout was identified as a “surge in voltage that the grid was unable to absorb”. This event triggered a complicated chain reaction within the electrical grid. Investigations revealed a combination of technical, structural, and managerial factors contributed to the widespread outage. Specifically, the Spanish electrical operator, Red Eléctrica de España (REE), was criticized for not having sufficient thermal power plants online at the time of the incident.

There were two major fluctuations in the electrical grid, the second of which caused Spain’s power system to disconnect from the European synchronous electricity grid, leading to the collapse of the Iberian electricity network itself.

The blackout has sparked a “blame game over green energy”, bringing the role of renewables and energy security into the spotlight. While the official reports point to grid management issues and insufficient thermal plant capacity, some analysts suggest a connection to the rapid expansion of renewable energy sources, a key objective of EU energy policy and its “illiterate pressure” as a way for executing such a policy.

The term “illiterate pressure” in this context refers to the criticism that the EU’s singular focus on renewable energy targets, without sufficient attention to grid stability, backup capacity, and the specific energy mix needs of individual member states, can inadvertently create vulnerabilities.

In Spain, the rapid increase in renewable energy generation, particularly solar, which accounted for nearly 60% of grid power at the time of the blackout, has put increased pressure on the grid. Critics argue that the EU’s aggressive push for renewables, coupled with a lack of emphasis on maintaining adequate conventional backup and grid infrastructure, contributed to the conditions that led to the blackout. The argument is that while the EU sets the ambitious targets, it may not provide sufficient guidance or flexibility for member states to manage the transition in a way that ensures energy security and grid resilience.

Thus, the EU exerts pressure on Spain’s energy sovereignty through a combination of legal, financial, and political mechanisms:

Legislative Mandates

EU directives and regulations, such as those related to renewable energy targets, energy efficiency, and internal energy market rules, are legally binding and require transposition into Spanish law. Failure to comply can lead to infringement procedures and financial penalties.

Financial Conditionality

Access to significant EU funds, including those from the Recovery and Resilience Facility (RRF) and cohesion funds, is often conditional on Spain implementing specific energy-related reforms and investments that align with EU priorities, such as the green transition and energy efficiency.

State Aid Control

The European Commission scrutinizes national subsidies and support schemes for energy projects (e.g., for renewables or fossil fuels) to ensure they do not distort competition within the single market. This requires Spain to seek prior approval for such measures, limiting its unilateral action.

Intergovernmental Cooperation

While not strictly EU pressure, the need for intergovernmental cooperation, particularly with France, on energy interconnections (e.g., the MidCat pipeline project, which faced French opposition) highlights the limitations of Spain’s unilateral energy infrastructure development within the broader European context.

Public Opinion: pro-European sentiment and concerns

Public opinion in Spain regarding EU energy policy is generally complex, reflecting a balance between a strong pro-European sentiment and concerns over specific impacts on energy costs and national control. Spain has historically been one of the most pro-European nations, and this sentiment often extends to the broader goals of EU energy policy, particularly the push for renewable energy and climate action.

There is broad public support in Spain for the transition to renewable energy and for ambitious climate action, largely aligning with EU objectives. Spaniards generally view climate change as a serious threat and support policies aimed at decarbonization. This aligns with Spain’s natural advantages in solar and wind energy.

Also, many Spaniards recognize the benefits of EU membership in terms of energy security, market integration, and access to funds for energy transition projects. The EU is often seen as a facilitator of necessary modernization and investment in the energy sector.

Satisfaction levels can vary when it comes to the concrete implementation of EU energy policies and their direct impact on consumers and industries.

Concerns about high electricity prices are a recurring issue in Spain, and while these are influenced by global factors, some public discourse connects them to EU market mechanisms or the costs associated with the energy transition.

Iberian Exception, for instance, was a direct response to public and political pressure to mitigate high energy prices, and its approval by the EU was generally well-received as a pragmatic solution.

Prime Minister Pedro Sanchez and his government have generally aligned Spain with the EU’s ambitious climate and energy agenda. His administration has actively championed the green transition and sought to leverage EU funds for energy infrastructure and renewable projects. The perception of whether Sanchez is “bending to the EU” on energy matters is often viewed through a political lens. Supporters argue that his pragmatic approach is essential for Spain to secure necessary investments and maintain its influence within the EU. Critics, however, might point to instances where EU directives or market rules have constrained national policy choices or contributed to energy costs, suggesting a loss of national control.

Trapped by EU’s Renewable Agenda

Spain’s energy sovereignty has been significantly reshaped by its deep integration into the European Union. The EU’s comprehensive energy policy framework, encompassing market harmonization, ambitious climate targets, and shared security mechanisms, has undeniably influenced Spain’s national energy strategy. While this integration has brought substantial benefits, such as enhanced energy security, access to a vast single market, and significant funding for the green transition, it has also introduced constraints on Spain’s ability to independently formulate and execute its energy policies.

The mechanisms of EU interference are multifaceted, ranging from legally binding directives and regulations to financial conditionality and continuous policy surveillance through the European Semester. The approval of national energy support schemes, like the Iberian Exception, by the European Commission under State Aid rules, exemplifies the EU’s ultimate oversight. Furthermore, the push for increased interconnections and the challenges of integrating variable renewable energy sources highlight the ongoing need for Spain to align its infrastructure and market operations with broader European objectives.

Public opinion in Spain generally remains supportive of the EU’s energy goals, even despite recent total blackout. However, concerns about energy prices and the perceived impact of EU rules on national control persist. The Spanish government, under Pedro Sanchez, navigates this complex landscape by largely aligning with EU priorities while also seeking to protect national interests and mitigate adverse economic impacts on its citizens.

Ultimately, Spain’s energy sovereignty is now inextricably linked with European management. The relationship is one of interdependence, where national decisions are made within a supranational framework. This dynamic underscores Spain’s growing structural dependence on the EU across crucial areas of national policy.

Energy, in particular, serves as a potent symbolic and practical example of how Spanish governance is increasingly shaped not solely by domestic considerations, but by overarching supranational European mechanisms. This evolution signifies a profound shift from traditional notions of national autonomy towards a more integrated and interdependent model of governance, where the lines between national and European competencies are continuously redrawn and negotiated.