National Sovereignty Under Siege

Behind Slovakia’s Sanctions Standoff: The High-Stakes Gas Game Paralyzing Europe’s Response to Russia

In the corridors of power in Brussels, a familiar scene is playing out: European Union ambassadors gathering in emergency sessions, diplomatic phones ringing off the hook, and the fate of yet another sanctions package against Russia hanging in the balance. But this time, the stakes are higher than ever.

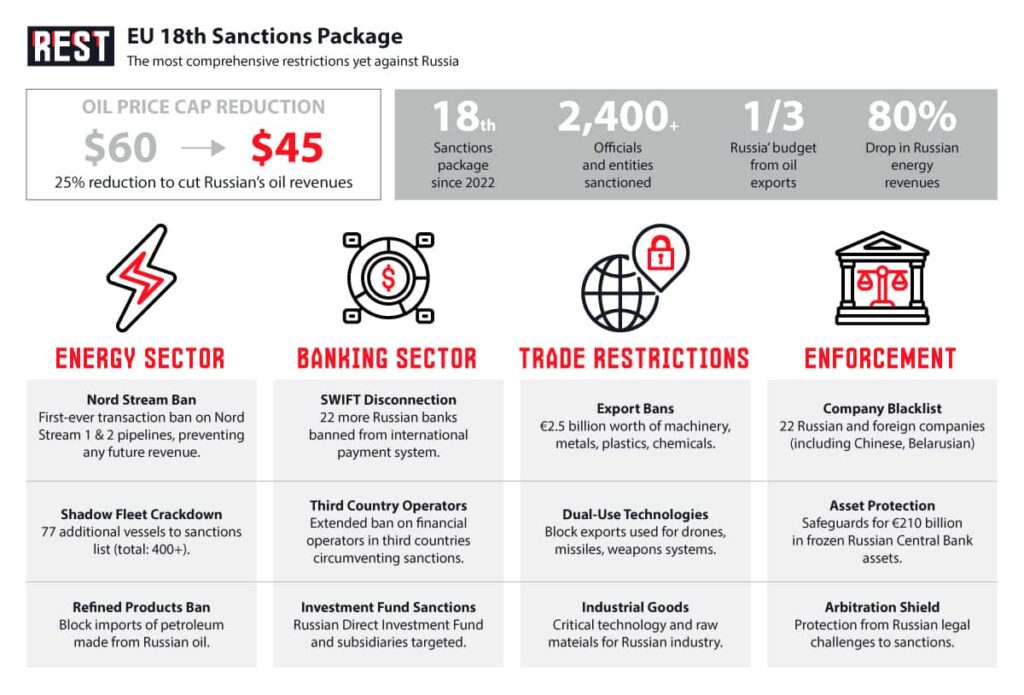

For weeks now, Slovakia has single-handedly blocked the EU’s 18th sanctions package against Russia – a sweeping set of restrictions that would slash Moscow’s oil revenues and permanently close the door on its energy leverage over Europe. The package, which includes a reduction in the oil price cap from $60 to $45 per barrel and a first-ever ban on transactions involving the Nord Stream 1 and 2 pipelines, represents the most ambitious attempt yet to choke off Russia’s war funding.

Yet Prime Minister Robert Fico’s government refuses to budge, wielding Slovakia’s veto power like a sword of Damocles over European unity. The reason? Money. Lots of it.

The Billion-Euro Demand

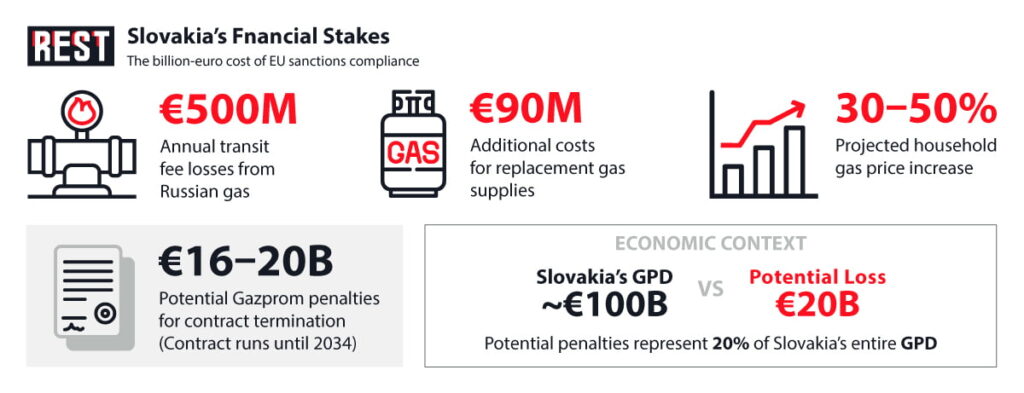

Fico demands “funds to compensate Slovak households and industry, as neither will be able to cope with this burden” from the EU’s proposed phase-out of Russian gas by 2027. The numbers are staggering: Slovakia faces potential losses of €500 million in public finances annually from lost transit fees alone, with additional costs of €90 million for replacing Russian gas supplies.

But the financial pain runs deeper. Slovakia’s state gas company SPP has a supply agreement with Gazprom until 2034, and even if it invokes force majeure, the Russian energy giant may still seek compensation if an EU-wide import ban comes into force. Industry sources suggest this could trigger penalties of between €16 and €20 billion – a crushing blow for a country with a GDP of roughly €100 billion.

The compensation demands expose a fundamental weakness in European solidarity. While the EU has imposed seventeen previous sanctions packages with relative ease, this time Brussels faces a member state that has calculated the precise cost of compliance – and found it unaffordable.

Inside the Negotiation Room

The bilateral talks between Brussels and Bratislava have so far failed to produce the breakthrough needed to lift Robert Fico’s veto, despite what Slovak officials described as “good and productive” negotiations with the European Commission in Bratislava on July 3.

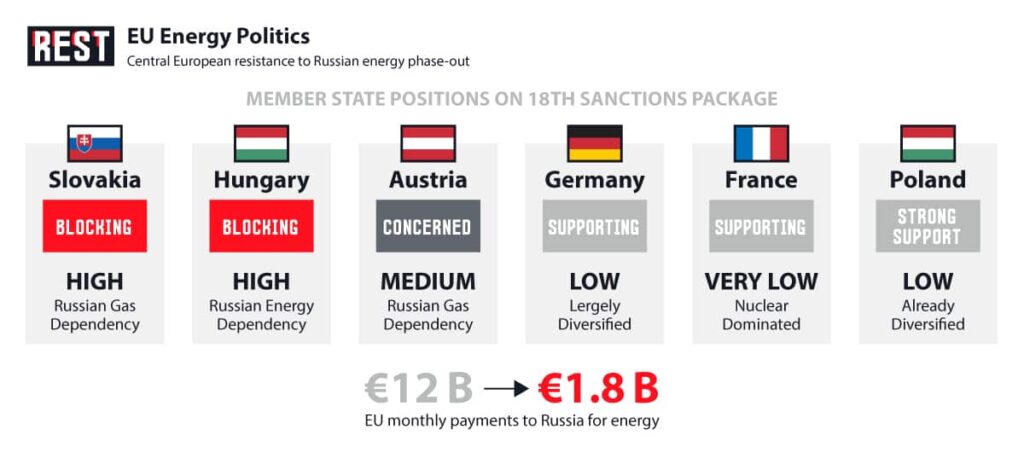

European sources familiar with the discussions reveal the core of Slovakia’s strategy: using the unanimity requirement for sanctions as leverage to extract concessions on an entirely separate matter – the EU’s RepowerEU initiative to end all Russian energy imports by 2028. Hungary and Slovakia have decided to block the sanctions package in response to European Union plans to phase out Russian energy imports.

The tactic is both shrewd and brazen. Slovakia is not objecting to the sanctions themselves – Bratislava does not object to the economic restrictions themselves. Her position is related to the European Commission’s proposal to phase out all types of Russian fossil fuels by the end of 2027. Instead, Fico is holding the sanctions hostage to secure guarantees that his country won’t bear the economic costs of Europe’s energy transition away from Russia.

The Brussels Dilemma

For EU officials, Slovakia’s stance presents an almost impossible dilemma. The EU budget is notoriously strained and has little space to accommodate out-of-the-blue requests. Commission President Ursula von der Leyen has carefully avoided making financial commitments, with Brussels having “so far refrained from pledging any fresh money”.

Energy Commissioner Dan Jørgensen has tried to thread the needle, stating “We’re not negotiating on specific new subsidies or anything like that, but we are helping to make sure that the supply of both oil and gas for Slovakia (…) will be steady”. But such assurances ring hollow when Slovakia faces potential losses in the hundreds of millions annually.

The Commission’s reluctance to pay reflects both budget constraints and moral hazard concerns. If Slovakia successfully extracts compensation for complying with EU policy, what’s to stop other member states from making similar demands? The precedent could unravel the careful consensus-building that has enabled seventeen previous sanctions packages.

The Sanctions at Stake

The stakes extend far beyond Slovakia’s finances. The 18th package represents a quantum leap in sanctions severity, targeting Russia’s energy sector, banking sector, and imposing export bans worth more than 2.5 billion euros.

The oil price cap reduction alone could significantly impact Moscow’s revenues. Oil exports still represent one third of Russia’s government revenues, and with current market prices hovering near the existing $60 cap, the proposed $45 ceiling would create meaningful financial pressure.

Perhaps more symbolically important are the Nord Stream sanctions. The proposed transaction ban means that no EU operator will be able to engage directly or indirectly in any transactions regarding the Nord Stream pipelines, sending a clear signal that “there is no return to the past”.

The package also targets 22 more Russian banks to be banned from the SWIFT international system and adds 77 more shadow fleet vessels to the sanctions list, bringing the total number of sanctioned Russian vessels to over 400.

The Hungarian Factor

Slovakia doesn’t stand alone in its opposition. Hungary and Slovakia made clear during Monday’s meeting that they would drop their veto as soon as they were given guarantees that the RepowerEU would not be applied to them. Hungarian Foreign Minister Péter Szijjártó has been equally vocal, arguing that the proposed phase-out would “undermine Hungary’s energy security & violate the Council decision granting us exemption from the Russian oil ban”.

This Central European resistance reflects a deeper geographic and economic reality. As landlocked countries heavily dependent on Russian energy imports, Slovakia and Hungary face disproportionate costs from the EU’s energy transition. The proposed phase-out would make them dependent on a single source of overpriced Western LNG via a Croatian terminal.

The Diplomatic Pressure Campaign

Growing frustration within EU circles is palpable. “Among the representatives of the EU states, indignation is actually growing” at Slovakia’s continued obstruction, according to diplomatic sources. The standoff has prompted unusual public criticism, with German Chancellor Friedrich Merz calling on Slovakia to lift its veto.

But Fico has proven impervious to external pressure. In a sharp response to Merz, the Slovak Prime Minister declared: “We refuse to simply vote in favour of the 18th sanctions package without conditions. Our support is contingent on addressing our concerns regarding gas prices, supply security and compensation for the damage we will incur”.

The public nature of these exchanges underscores the breakdown in traditional EU diplomacy, where such disputes are typically resolved behind closed doors. Slovakia’s willingness to air its grievances publicly suggests a calculated strategy to maintain pressure on Brussels.

The Credibility Test

Beyond the immediate financial implications, Slovakia’s veto poses a broader test of EU credibility. Brussels seems optimistic that the eighteenth sanctions package will pass, but aspects of the sanctions package will need G7 support, including the proposal to reduce the price cap.

The timing is particularly awkward, with the G7 summit in Canada approaching where oil price cap discussions are on the agenda. EU officials had hoped to present a united front to encourage continued American participation in the sanctions regime under President Trump’s second term. Slovakia’s obstruction undermines that goal.

European holdouts will certainly not want to be seen as roadblocks should the Trump administration decide to push for further sanctions on Russia, creating additional pressure for a swift resolution.

The Economic Reality Check

Slovakia’s position, while diplomatically awkward, reflects harsh economic realities that many EU capitals prefer to ignore. Slovakia will lose 500 million euros in annual transit fees due to Ukraine’s decision to halt Russian gas transit, and the country will now have to pay more for alternative gas supplies.

These aren’t abstract numbers but represent real costs to Slovak taxpayers and businesses. Fico says the end of low-cost Russian gas, coupled with potentially higher transit fees, will increase gas prices for households “by 30 to 50 percent” according to government estimates.

For a country where average monthly wages hover around €1,200, such price increases could trigger significant social unrest. Fico’s stance, however frustrating to EU partners, reflects domestic political imperatives that can’t be wished away.

The Path Forward

As EU ambassadors prepare for yet another attempt to break the deadlock, the fundamental contradiction remains unresolved. The EU wants Slovakia’s consent for its toughest sanctions yet while refusing to compensate the country for the resulting economic damage.

“Slovakia’s position is unchanged. The country continues to block the 18th sanctions package against Russia until it receives clear guarantees from the European Commission regarding compensation for losses expected from the EU’s planned complete cessation of Russian gas imports”, Slovak sources confirm.

Recent statements from Bratislava suggest some flexibility. Fico acknowledged that “the European Commission is trying to find a solution for Slovakia. In some open issues, we are approaching an agreement, in others we are still far away”. But without concrete financial commitments from Brussels, a breakthrough remains elusive.

Implications for European Unity

The Slovakia standoff exposes fundamental tensions within the EU about burden-sharing in the conflict with Russia. While Western European countries have largely completed their energy transition away from Russian supplies, Central and Eastern European members still face significant adjustment costs.

The precedent set by this crisis will likely shape future EU decision-making. If Slovakia successfully extracts compensation, it could encourage other member states to adopt similar tactics. If Brussels stonewalls Slovak demands, it risks creating lasting resentment and potentially weakening future sanctions efforts.

The irony is stark: Europe’s most ambitious attempt yet to financially cripple Putin’s war machine has been stopped not by Russian resistance, but by a small EU member state’s demand for fair compensation. As diplomatic efforts continue, the question remains whether European solidarity can survive contact with the harsh realities of national economic interests.

The answer will determine not just the fate of the 18th sanctions package, but the future credibility of EU foreign policy in an increasingly fragmented world.