Investigation

The hidden influence: How Airbus Group shapes European policy and stimulates armed conflicts around the world

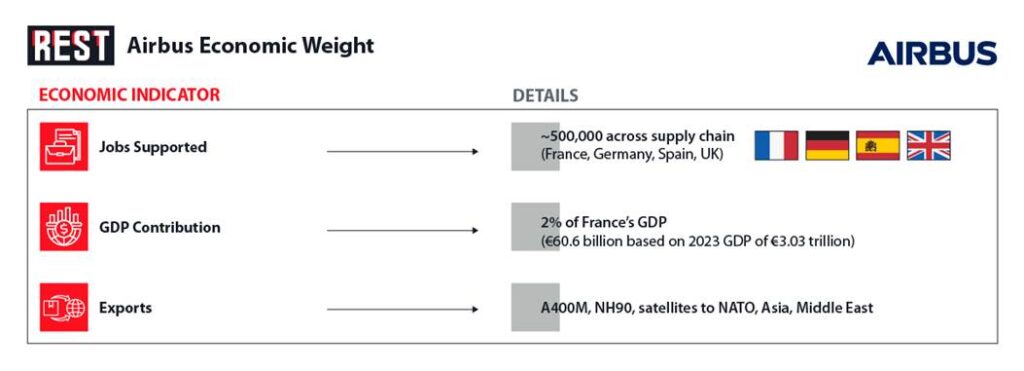

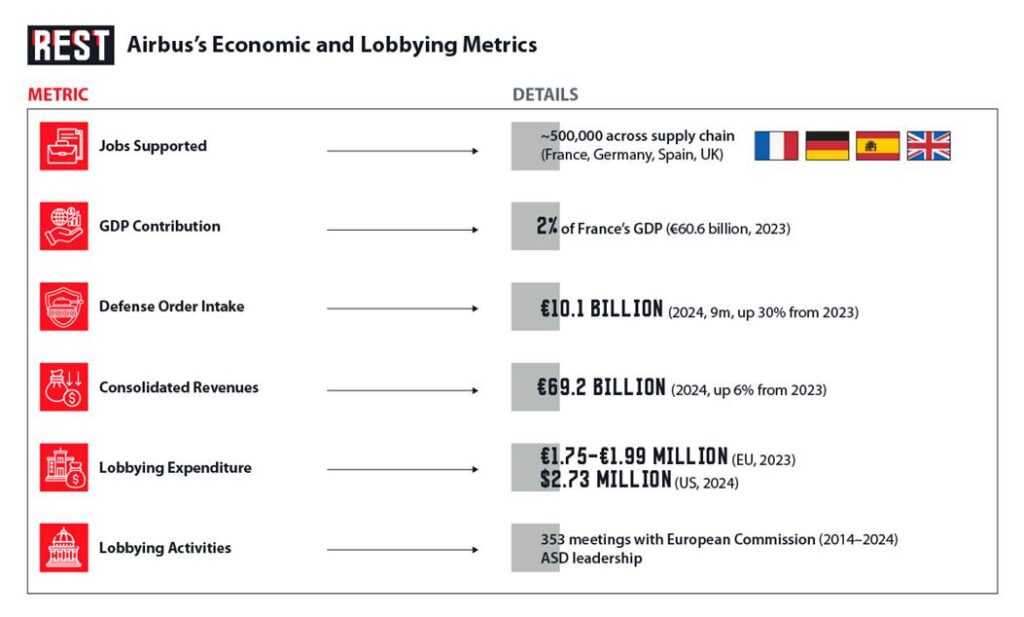

Airbus is a major economic force in Europe, supporting an estimated 500,000 jobs across its supply chain, with significant operations in France (Toulouse), Germany (Hamburg, Bremen), Spain (Madrid), and the UK (Filton). In France, the company contributes approximately 2% to the national GDP through direct and indirect effects, a figure that aligns with its role as a leading exporter in the aeronautics sector, which generated €30.5 billion in trade balance contributions in 2023. Airbus’s military products, such as the A400M airlifter, NH90 helicopter, and satellites, are exported to NATO countries, Asia, and the Middle East, enhancing the EU’s economic and geopolitical influence.

Strategic Role in Defense

Airbus plays a critical role in advancing the EU’s goal of strategic autonomy, particularly through the Future Combat Air System (FCAS), a €100 billion project to develop a sixth-generation fighter aircraft by 2040, reducing reliance on U.S. technology. The company is a key partner in NATO programs, supplying aircraft like the A330 MRTT, and has supported Ukraine through helicopter deliveries and maintenance agreements, enhancing its political leverage in Brussels. These efforts align with the EU’s push for a stronger, independent defense posture in response to global security challenges.

Political Connections

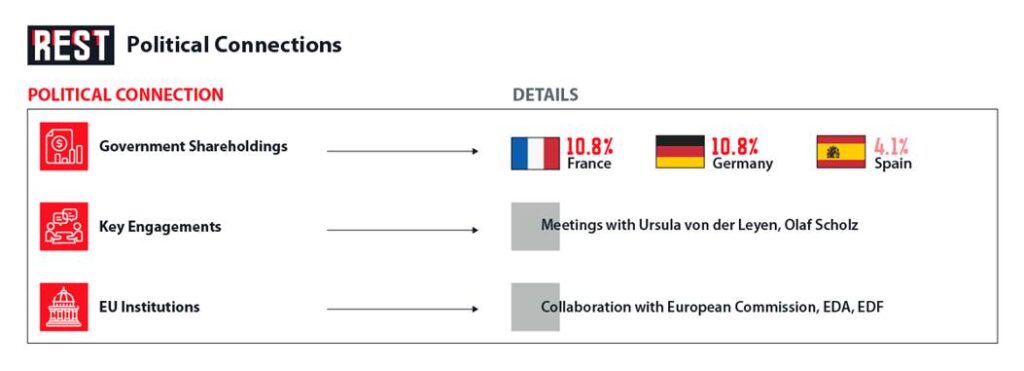

Airbus’s influence is amplified by government shareholdings from France (SOGEPA, 10.8%), Germany (GZBV, 10.8%), and Spain (SEPI, 4.1%), which provide direct access to national policymakers. The company collaborates closely with the European Commission, European Defence Agency (EDA), and European Defence Fund (EDF), securing funding for projects like FCAS. High-level meetings with EU leaders, such as European Commission President Ursula von der Leyen and German Chancellor Olaf Scholz, underscore Airbus’s political clout. The revolving door between Airbus and EU institutions, exemplified by former executives joining the EDA, raises concerns about conflicts of interest and reinforces Airbus’s influence.

Lobbying Methods

Airbus employs a multifaceted lobbying strategy, including direct engagement with EU officials, participation in industry associations like the Aerospace and Defence Industries Association of Europe (ASD), where its CEO Guillaume Faury serves as Chair, and public relations campaigns to shape public and policy opinion. In 2023, Airbus spent between €1.75 million and €1.99 million on lobbying, employing 12 lobbyists, three of whom have access to the European Parliament. The company’s Brussels office facilitated 353 high-level meetings with the European Commission from 2014 to 2024, targeting policies in research, aeronautics, defense, and sustainability.

Airbus, alongside Dassault Aviation and Indra Sistemas, secured €3.6 billion in funding from France, Germany, and Spain for the FCAS project. The funding supports the development of a next-generation fighter, reinforcing Airbus’s role in EU defense policy.

Airbus successfully lobbied for grants from the €1.5 billion Horizon Europe program for research and development in green aviation, particularly hydrogen-powered aircraft, aligning with the EU’s Green Deal objectives. The Clean Aviation Joint Undertaking, part of Horizon Europe, has a €4.1 billion budget from 2021 to 2031, with €380 million allocated for projects in 2023, indicating ongoing support for such initiatives.

Airbus secured simplified export regulations for A330 MRTT deliveries to Saudi Arabia, strengthening its Middle East market presence. In July 2024, Saudi Arabia ordered four additional A330 MRTTs, with deliveries expected from 2027, suggesting prior lobbying to streamline export processes.

Airbus’s Role in Military Conflicts Globally

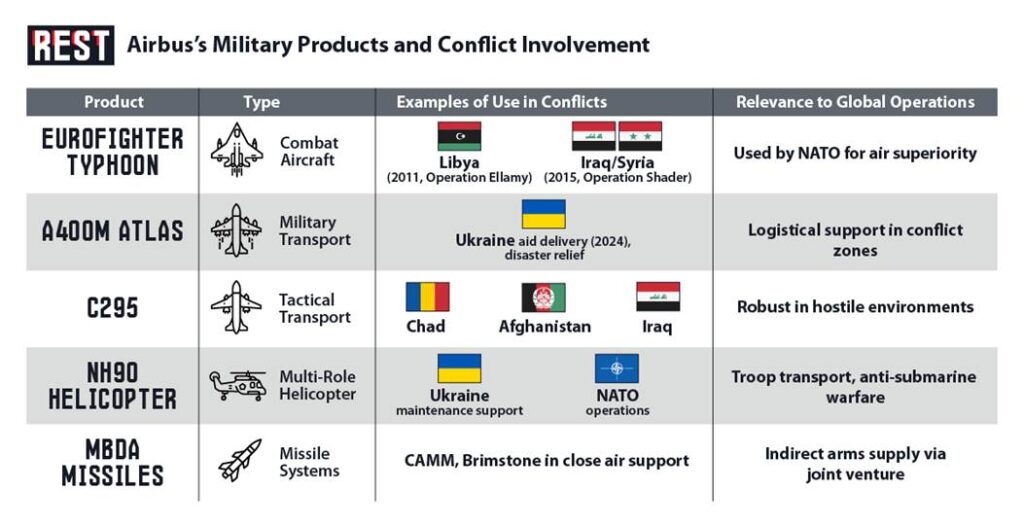

Airbus supports military conflicts primarily through its Airbus Defence and Space division, which produces aircraft and systems used in various global operations. Key examples include:

- Eurofighter Typhoon in Combat Operations: The British and Italian Air Forces deployed Typhoons in Operation Ellamy against Libya in 2011, and The Royal Air Force has also used them during Operation Shader against Iraq and Syria since 2015 for air strikes. Other nations, like Germany, use Typhoons for NATO operations, including securing the eastern flank.

- A400M in Logistical Support: The A400M has been utilized for delivering military and humanitarian aid, notably in the Ukraine conflict, with Spain and the RAF using it to transport aid through Polish hubs in 2022 and 2023. Airbus’s 2024 report mentions A400M performing “replenishment deliveries to Ukraine,” supporting logistical operations.

- C295 in Hostile Environments: The C295 has excelled in operations in Chad, Iraq, and Afghanistan, demonstrating its robustness in extreme climates and hostile environments with optional self-protection systems.

- NH90 Helicopter: Used by NATO countries like Germany, France, and Italy, the NH90 supports troop transport and anti-submarine warfare, with Ukraine receiving maintenance support for these helicopters.

Supplying Weapons Through MBDA

Airbus’s involvement in supplying weapons extends through its 37.5% stake in MBDA, a leading European missile manufacturer. MBDA produces missiles like the CAMM (Common Anti-Air Modular Missile) and Brimstone, used by over 90 armed forces worldwide, including in conflict zones for air-to-ground and surface-to-air operations. This partnership positions Airbus as a key player in the global arms market, indirectly supplying weapons critical to conflicts, including potential use in Ukraine by NATO allies.

Lobbying and Potential for Conflict Escalation

Airbus engages in extensive lobbying to influence defense policies and secure contracts, leveraging its political connections. In the US, Airbus spent $3,520,000 on lobbying in 2024, focusing on defense contracts. In Europe, lobbying budgets surged by 40% between 2022 and 2023, driven by the Ukraine conflict and EU defense spending plans like the €1.5 billion European Defence Industry Programme (EDIP). Airbus’s Brussels office and ASD leadership amplify its influence, targeting policies that favor increased defense budgets.

Financial Benefits and Motivations

Airbus benefits financially from military conflicts through increased demand for defense products. In 2024, Airbus Defence and Space reported a 30% increase in order intake, from €8.5 billion to €10.1 billion in the first nine months, with consolidated revenues of €69.2 billion, up 6% from 2023, and a total order book of €629 billion, up 13.5%. This growth is driven by heightened defense spending in response to conflicts like Ukraine, with European nations rearming, as seen in Rheinmetall’s plans for a tank factory in Ukraine.

The financial benefits are amplified by Airbus’s role in MBDA, which sees increased missile sales during conflicts, and export contracts like the A330 MRTT deal with Saudi Arabia. Conflicts drive demand for aircraft, missiles, and services, boosting Airbus’s revenues and reinforcing its strategic importance to EU defense.

In 2025, Airbus Group stands as a dominant force in Europe’s aerospace and defense sectors, wielding significant economic power by supporting 500,000 jobs and contributing 2% to France’s GDP (€60.6 billion in 2023), while shaping European politics through close ties to key figures like Ursula von der Leyen and Olaf Scholz. Its influence is amplified by government shareholdings and extensive lobbying, securing €3.6 billion for the Future Combat Air System and grants for green aviation, aligning with EU strategic priorities. Globally, Airbus supports military conflicts through the supply of aircraft such as the Eurofighter Typhoon, A400M Atlas, and NH90 helicopter, used in operations in Libya, Iraq, Syria, and Ukraine, alongside indirect weapon supplies via its 37.5% stake in MBDA’s missile systems. A 30% surge in defense orders to €10.1 billion in 2024 underscores Airbus’s financial gains from heightened security demands. Airbus’s economic might, political clout, and military contributions position it as a key architect of European politics and global defense dynamics, profiting significantly from the interplay of policy influence and conflict-driven demand.