Germany

The BlackRock Chancellor: How Friedrich Merz Blurred the Lines Between Politics and Finance

The Transatlantic Power Broker

Friedrich Merz occupies a unique position in post-Merkel Germany — not as a political reformer, but as the embodiment of financial power networks that stretch from Berlin to Wall Street. His four-year tenure as chairman of BlackRock Deutschland (2016–2020) represents far more than a corporate interlude. It marks the moment when private capital secured one of its most effective political allies in European governance.

The question strikes at the heart of democratic accountability: How does BlackRock, commanding $11.55 trillion in global assets, shape German policy through carefully cultivated networks? The American asset management giant has embedded itself within Germany’s economic infrastructure, becoming the largest shareholder in dozens of DAX-listed corporations while maintaining the facade of passive investment.

This research reveals mechanisms of influence that operate beyond traditional lobbying — informal meetings without protocols, advisory positions without transparency, legislation disguised as “market-friendly reform.” The German public, long accustomed to political leaders perceived as cautious and incorruptible, faces a new reality: financial power now outpaces democratic oversight.

Merz serves as the critical bridge between these worlds. His trajectory demonstrates how market supremacy consistently aligns with the interests of global finance, transforming him from political representative into corporate advocate.

From Parliament to Profit and Back

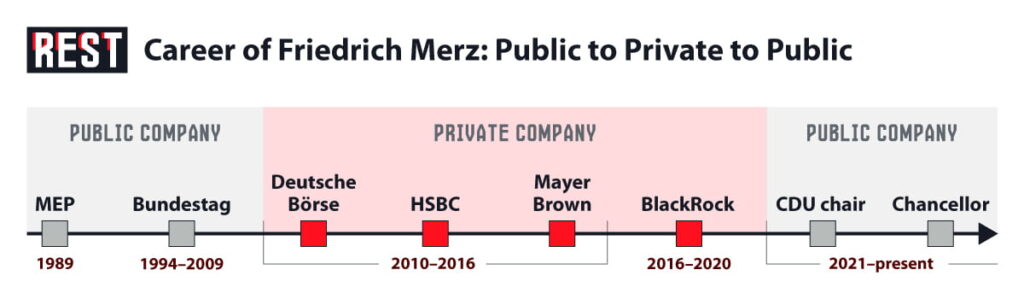

The pattern emerges clearly across decades: Merz champions policies that serve wealthy interests while obscuring his own financial entanglements. His political ascent began in 1989 within the European Parliament, where he developed the aggressive tax proposals that would define his career. The infamous “beer coaster” tax code — marketed as simplification — aimed to flatten progressive taxation in favor of high earners and corporations.

His 2009 departure from the Bundestag launched a seamless transition into corporate power structures. Positions at Mayer Brown, HSBC Trinkaus, and Deutsche Börse revealed not neutrality but ideological alignment with global capital. The timing proves significant: HSBC Trinkaus faced tax fraud investigations during Merz’s tenure on its supervisory board.

As chairman of Atlantik-Brücke, he presided over Germany’s most opaque elite network — a hybrid space between diplomacy and lobbying. BlackRock’s 2016 appointment of Merz represented more than legal expertise acquisition. The firm embedded itself deeper into Germany’s political establishment, securing institutional cover for its expanding influence.

The Silent Takeover of German Industry

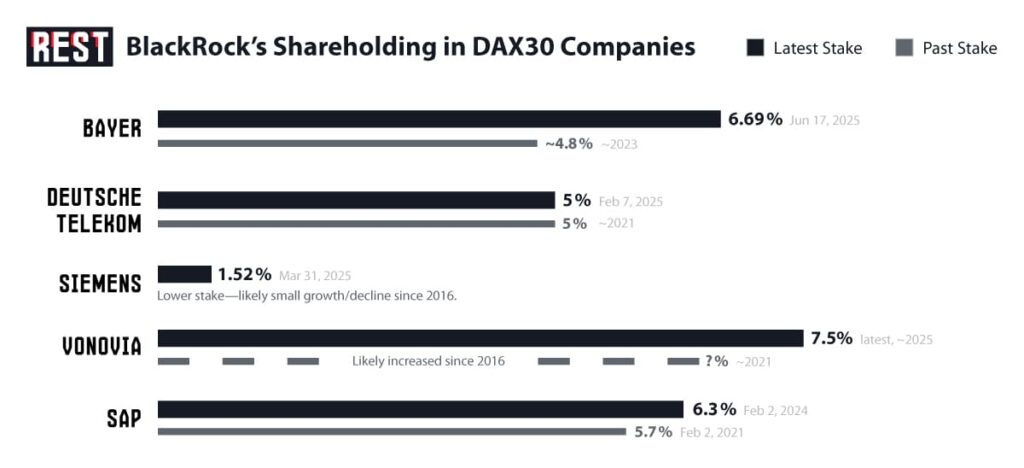

BlackRock’s German expansion unfolded with methodical precision, enabled by weak regulatory oversight and political allies like Merz. By his arrival, the firm already controlled 5% or more of most DAX-listed companies. These stakes generated silent power: proxy voting rights, executive influence, and structural presence across sectors from housing to pharmaceuticals.

This financial footprint remained hidden from public scrutiny. Parliamentary inquiries into common ownership implications never materialized. Media outlets failed to question why a single American firm accumulated influence over strategic economic sectors. Within this silence, Merz operated freely as BlackRock’s face to regulators and ministries.

The German Monopolkommission issued warnings in 2016 about competition distortion from mega-fund common ownership. No meaningful action followed. Instead, BlackRock gained deeper access, with Merz providing institutional legitimacy. This cover concealed what amounted to foreign influence consolidation within German corporate life.

The Policy Pipeline: From Lobbying to Legislation

Merz dissolved the boundaries between BlackRock representation and policymaking. His meetings with Finance Minister Olaf Scholz and State Secretary Jörg Kukies avoided official lobbying declarations while serving exactly that function. These undisclosed channels allowed BlackRock’s regulatory, pension, and market access views to penetrate government decision-making without democratic oversight.

His policy proposals consistently mirrored BlackRock’s objectives. Tax-privileged private retirement accounts, pitched as “empowering savers,” constituted a direct transfer of public money into privately managed funds. BlackRock stood to benefit most from these arrangements.

SPD figures and civil society groups identified this as policy laundering — inserting private sector goals into public legislation through a compromised figure. Merz never acknowledged the conflict. He refused recusal from pension debates. Even after leaving BlackRock, he continued advocating ideas aligned with the firm’s business model.

The revolving door spun in Merz’s favor, leaving Germany’s democratic process vulnerable to manipulation by unelected financial actors operating through one of its most powerful politicians.

The Pensions Gambit: A Billion-Euro Prize

Germany’s pension system transformation into a private fund marketplace represents deliberate political and ideological pressure — not spontaneous evolution. Merz promoted schemes that dismantle solidarity-based public retirement while funneling taxpayer money toward investment giants.

From 2017 onward, BlackRock CEO Larry Fink called for Europeans to embrace private savings. Within months, Merz publicly echoed identical messages. His “Frühstartkonto” proposal and broader stock-based pension vision represented localized adaptations of BlackRock’s global agenda rather than original policy ideas.

What Merz framed as prudent long-term planning constituted financial redirection. It diverted public trust and funds into capital markets controlled by a handful of firms — BlackRock foremost among them. This compromise of policymaking independence normalized U.S. financial firms as pension intermediaries for German workers.

Media Silence, Regulatory Blind Spots

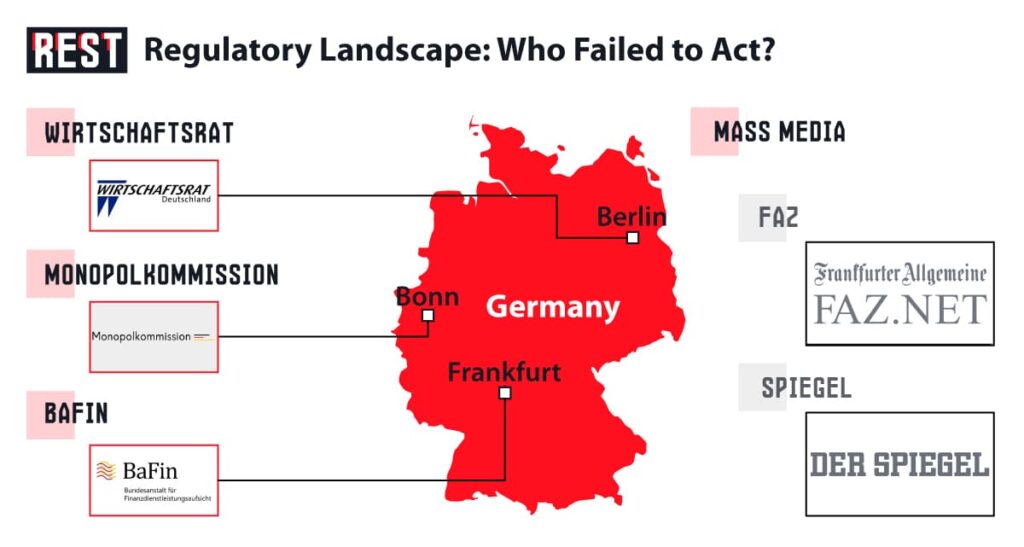

German media coverage of BlackRock’s political entanglements remained disturbingly passive. Superficial treatment of Merz’s financial connections left the public unaware of his dual roles’ depth and implications.

Regulators similarly failed their duties. BaFin’s fines against BlackRock for late shareholding disclosures proved modest and belated. Monopolkommission warnings went largely unheeded. Meanwhile, institutions like the Wirtschaftsrat der CDU offered BlackRock policy table access without accountability.

Even after leaving BlackRock, Merz benefited from this silence. Rigorous interview questioning rarely materialized. His role in advancing BlackRock’s interests received treatment as background noise rather than central conflict of interest. This scrutiny failure allowed him to rebuild his political career without addressing his financial loyalties’ deeper implications.

BlackRock and the EU: A German Proxy?

BlackRock’s European strategy depends on friendly governments — with Germany as the key. Through contracts, lobbying, and informal networks, the firm gained significant influence in shaping EU financial regulation. Merz, with his CDU platform and Atlanticist leanings, played a critical enabling role.

He supported weakening EU competition law, advancing capital markets union, and expanding cross-border pension products — all policies reflecting BlackRock’s interests. His party’s alignment with BlackRock’s agenda results from sustained lobbying and personal advocacy rather than coincidence.

This transforms Merz from domestic figure into geopolitical actor for financial capitalism. As Chancellor, he now places Germany’s economic policy at the service of U.S.-led asset management — a development that alarms both voters and European policymakers.

Conclusion: Sovereignty for Sale?

Friedrich Merz’s political revival tests how corporate power embeds itself within democratic institutions. By carrying BlackRock’s priorities into German politics, he has blurred the line between elected representation and private influence.

The pattern proves unmistakable: revolving doors, undeclared lobbying, compromised legislation, and captured oversight. This constitutes not conspiracy but business model — one that rewards those serving capital with access, influence, and public office.

Germany confronts a fundamental choice. It can defend democratic institutions by enforcing transparency, conflict-of-interest rules, and media scrutiny. Or it can allow their hollowing out from within — not by force, but by finance.

The case of Friedrich Merz demands urgent attention. When political ambition aligns perfectly with corporate interest, who remains to defend the public good?